Delta provides its professional investment expertise and services for: executions, administration, and reporting by a platform provider recommended by our team or chosen by the client

Key benefits of Delta Managed Accounts comparing to other investment solutions

Features

Delta Managed

Accounts

Managed

Funds

Mutual

Funds

Self Managed

Investments

Profitability

High

Moderate

Low

Low

Risk

Moderate-Low

High

Low

High

Transparency

Excellent

Poor

Poor-Moderate

Excellent

Client Direct Ownership

Yes

No

No

Yes

Portfolio Construction

Individualized Model Portfolio

Manager's Discretion

Fund Discretion

Investor's Discretion

Diversification

High

Moderate

Moderate

Low

Tax Efficiency

Good

Poor

Poor

Moderate

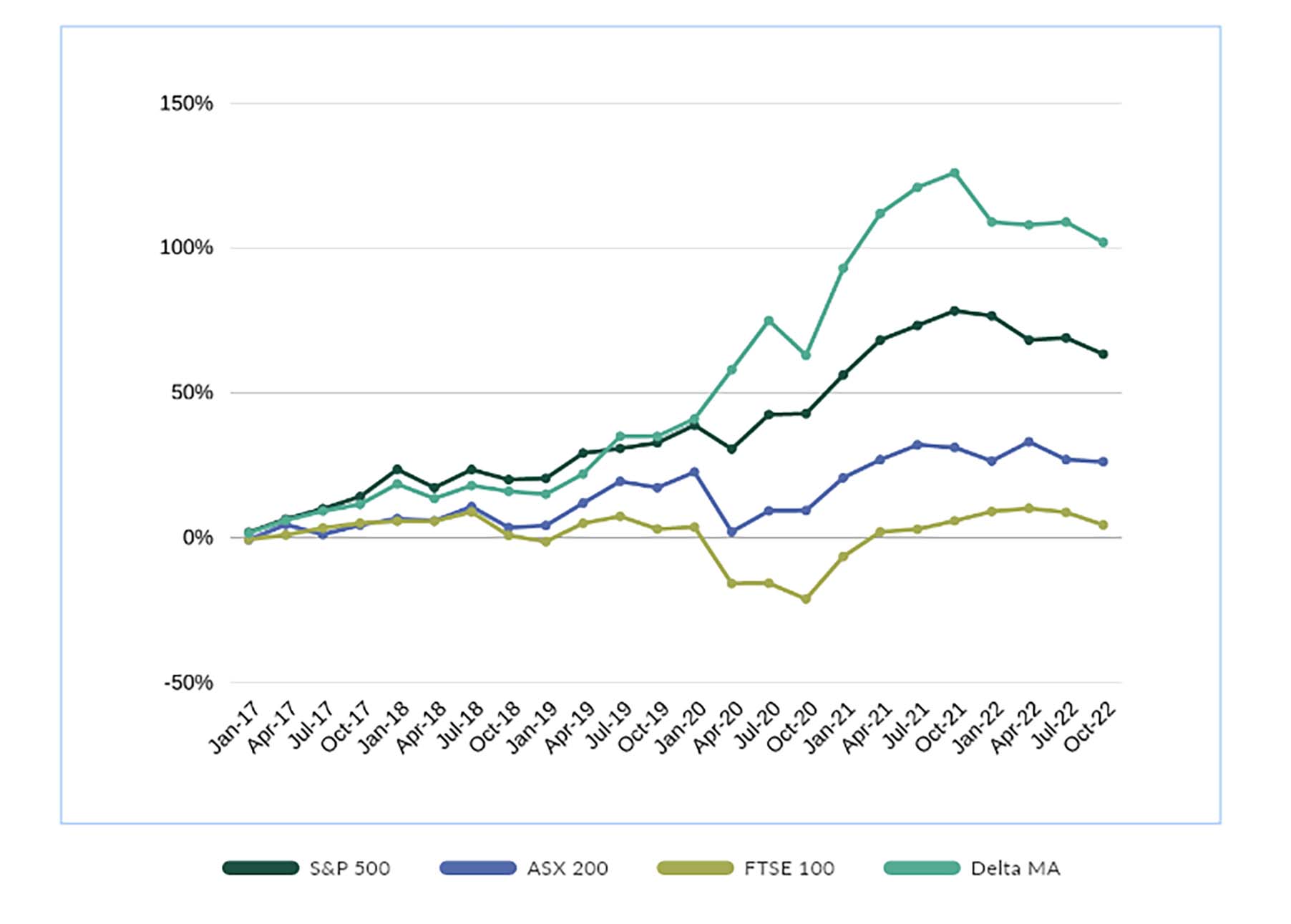

Performance example of one of our Portfolio Models

Investment Parameters

Management style

Benchmark

Minimum number of securities

Single security allocation limit

Diversification

Min Target Gain

Active

S&P 500, FTSE 100, ASX 200

20

5%

High

35%

Portfolio Profile

Investments

Min Investment horizon

Ability to tailor Investments

Management Fee

Profit Sharing

Admin & Reporting fees

Global Equities

1 year+

Yes

% of Funds under management

% of net profit

None

Delta Performance vs Major Indices

Risk Disclaimer !

Leverage trading and cash investing In Equities, CFD’s and Derivatives carry a high-risk level that may not be suitable for all investors. Before deciding to trade and invest you should carefully consider your objectives, financial situation, needs and experience level. You should not invest in margin or cash securities unless you fully understand all the risks involved.